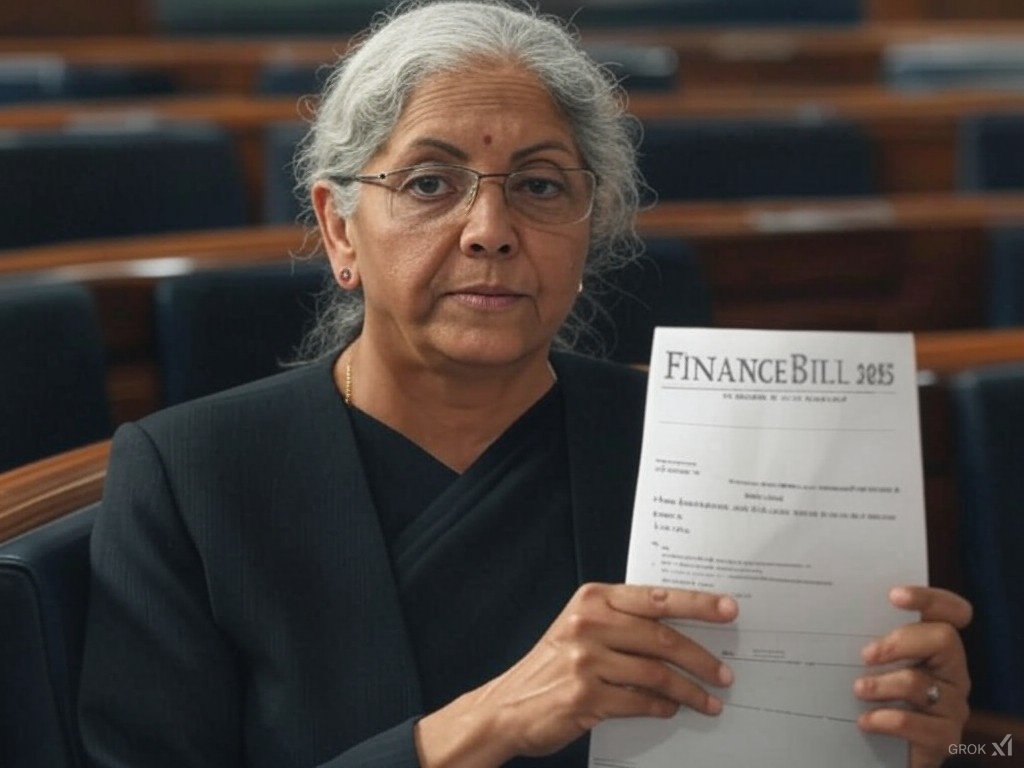

Finance Bill 2025: Finance Minister Nirmala Sitharaman is scheduled to present the Union Budget for the fiscal year 2025-26 on February 1, 2025, at 11 am in the Parliament. This upcoming budget marks Minister Sitharaman’s eighth consecutive presentation as India’s Finance Minister.

The Finance Bill 2025, which outlines the government’s financial proposals, will be a key component of this budget presentation. As of January 31, 2025, the Indian government’s Finance Bill 2025 is anticipated to introduce significant amendments aimed at enhancing tax compliance and efficiency.

Download Finance Bill 2025 PDF

Click here to download Finance Bill 2025 in PDF format.

One notable proposal is the integration of the Invoice Management System (IMS) into the Goods and Services Tax (GST) framework. Initially launched in November 2024, the IMS allows taxpayers to track invoices in real-time, aiming to reduce errors and curb tax evasion through fake invoicing. The upcoming amendment seeks to provide a legal basis for the IMS within the GST Act, thereby strengthening mechanisms to prevent fraudulent input tax credit claims.

Additionally, the Finance Bill is expected to upgrade the Income Tax Business Application (ITBA) to its next generation, ITBA 2.0. This enhanced platform will incorporate artificial intelligence to improve the assessment of returns, flag discrepancies, and reduce fraudulent activities. The upgrade aims to handle a larger taxpayer base more efficiently, offering real-time status tracking of returns, refunds, and assessments, thereby fostering greater transparency and efficiency in tax administration.

These proposed amendments reflect the government’s commitment to leveraging technology to enhance tax compliance and administration. The Finance Bill 2025 is expected to be introduced in the upcoming budget session of Parliament, where these proposals will be deliberated further.

The Finance Bill is typically presented alongside the Union Budget, which is usually announced on February 1st each year. Once the 2025 Union Budget is presented, the Finance Bill 2025 will be available for download on the official Union Budget website.