Online process for filing DIR 3 KYC WEB based form within due date of September. Late filing fee payment and extended last date for filing e-form DIR-3 KYC.

Aadhaar Card is mandatory for filing the form, if it is assigned. Otherwise, you may use your Voter ID or Passport or Driving Licence to be attached. Accordingly, copy of any one of the above selected information is to be attached while filing KYC form.

For Financial year 2019-20 onwards: Every Director who has been allotted DIN on or before the end of the financial year, and whose DIN status is ‘Approved’, would be mandatorily required to file form DIR-3 KYC before 30th April of the immediately next financial year.

After expiry of the respective due dates, system will mark all non-compliant DINs against which DIR-3 KYC form has not been filed as ‘Deactivated due to non-filing of DIR-3 KYC’.

e-Form DIR-3-KYC:

- First Time KYC: Every individual who holds a DIN as on 31st March of a FY submit e-form DIR-3-KYC on before 30th September of immediate next FY. This form is required for filing KYC details for the first time. That means if you hold DIN in FY 2019-20 then you have to submit KYC form on or before 30-Sept-2020.

- Update KYC: If you want to update mobile number or the email address, you shall update the same by submitting e-form DIR-3 KYC only.

Note that last date to file e-form DIR-3 KYC was 5th October, 2018 for every individual who has already been allotted a Director Identification Number (DIN) as at 31st March, 2018. However, the last date for filing DIR-3 KYC for Financial year 2018-19 has been extended till 14th October 2019.

Last Date for filing e-form DIR-3 KYC

- Up to 31.3.2018: 5th Oct. 2018.

- 1.4.2018 to 31.03.2019:

30thSept. 201914th October 2019. - 1.4.2019 to 31.03.2020: 30th Sept. 2020.

[Refer Rule 12A (Directors KYC)]

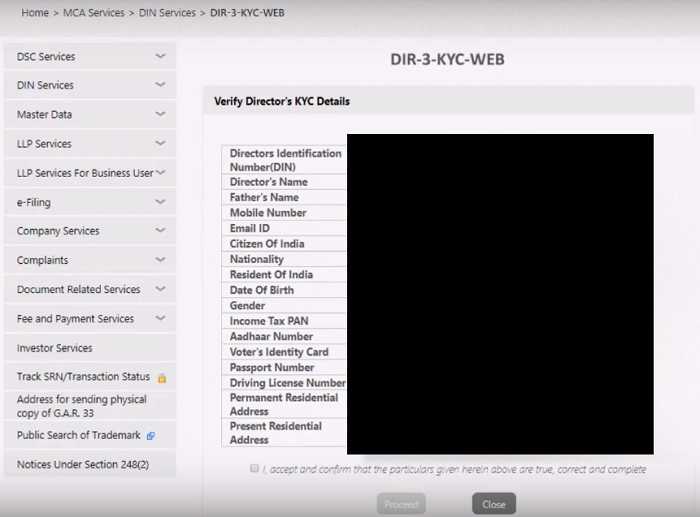

Web-Form DIR-3 KYC-WEB:

If you have already submitted e-form DIR-3 KYC in previous FY then submit web-form DIR-3 KYC-WEB for subsequent FY. In other words, DIR-3-KYC-WEB is to be filed only if DIR-3 KYC was submitted in the previous FY and no update is required in KYC details.

Last Date for filing web-form DIR-3 KYC-WEB

If you hold DIN up to 31.3.2018 and filed DIR-3 KYC form and details are same as filed in the form then file web-Form DIR-3-KYC-WEB for the first time on or before 30th September, 2019.

In case you hold DIN in FY 2018-19 (1.4.2018 to 31.03.2019): file DIR-3 KYC for the first time on or before 30th Sept. 2019 14th October 2019. Web based form is required to be filed for FY 2019-20.

Similarly, if you hold DIN between 1.4.2019 to 31.03.2020 then you have to file DIR-3 KYC form for the first time on or before 30th September, 2020.

[Refer Rule 12A (Directors KYC)]

Payment of Fee:

- Timely Filing KYC: No any fees is payable if you submit e-form DIR-3 KYC or web-form DIR-3 KYC-WEB within time i.e. till 30th September every FY.

- Delay or Not Filing KYC: ₹5,000 shall be payable in case DIN holder failed to file e-form DIR-3 KYC or DIR-3 KYC-WEB for the immediate previous FY (in delayed case). In other words, if it is filed after the due date, for DIN status ‘Deactivated due to non-filing of DIR-3 KYC’ a fee of Rs.500(Rupees Five Hundred Only) shall be payable.

[Refer Item VII of Annexure of the Companies (Registration Offices and Fees) Rules, 2014]

De-activate or Re-activate Directors KYC

If you not submit KYC details in e-form DIR-3-KYC or the web service DIR-3-KYC-WEB within stipulated time then CG or RD or any authorised officer shall deactivate your DIN.

The de-activated DIN shall be re-activated only after e-form DIR-3-KYC or the web service DIR-3-KYC-WEB is filed along with fee as prescribed under Companies (Registration Offices and Fees) Rules, 2014.

[Refer Rule 11 (Cancellation or surrender or Deactivation of DIN)]

How to file DIR-3-KYC-WEB based

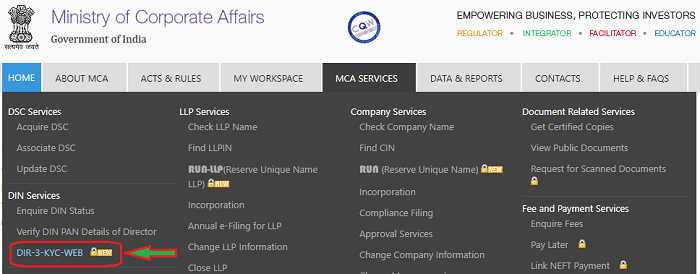

Strep-1: As it is after login service, you have to login first to your MCA account at http://www.mca.gov.in Thereafter, click on DIR-3-KYC-WEB under MCA Service top bar menu as shown in the screenshot.

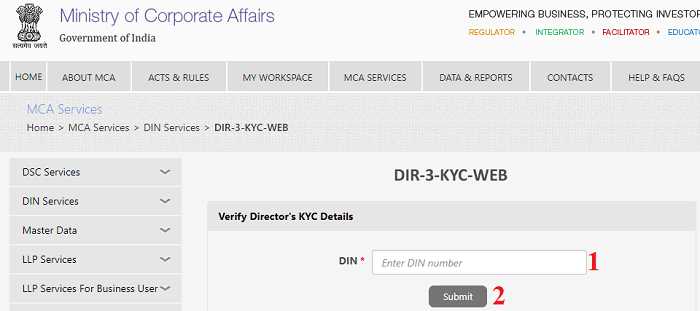

Step-2: Now, enter DIN number and click on submit button as shown in the screenshot below to verify.

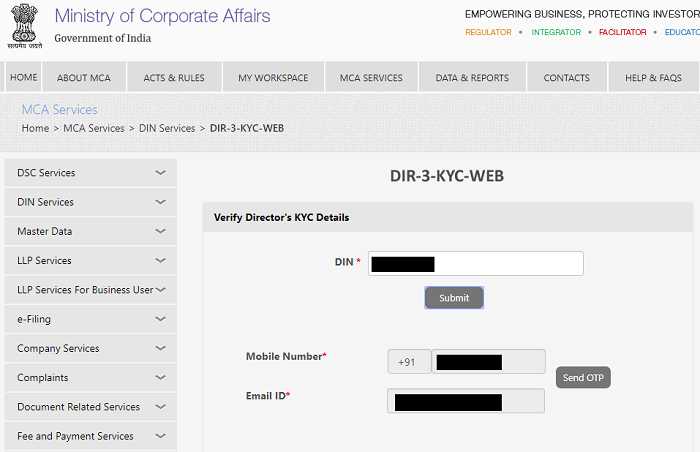

Step-3: Director’s mobile number and email address will be shown on the screen. Click on Send OTP to verify the KYC details.

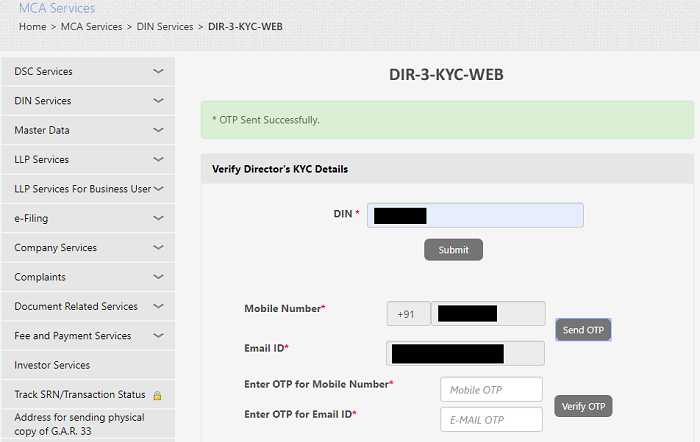

Step-4: Enter OTP sent to the respective email and mobile number and click on verify OTP.

Step-5: Now accept and confirm that particulars given herein are correct, true and complete. Then click on Proceed button as shown in the screenshot.

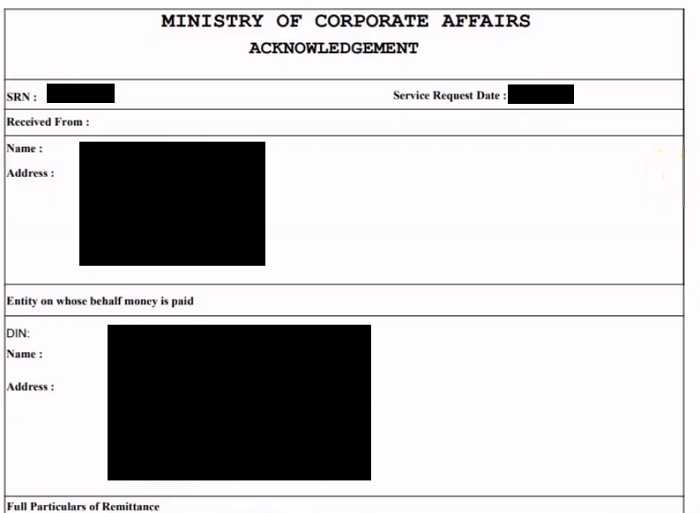

Step-6: After that you will see payment details and you should click on Continue button.

Step-7: That’s’ it. You are done. You will see the acknowledgement as shown in the screenshot.

Please feel free to ask any query related to above updated notes.