Online procedure for claiming ICSI paper wise exemption in CS Executive course and paper wise exemption in CS Professional course. Last date is 10th October, 2023 for claiming paper-wise exemption on the basis of qualification for Dec 2023 Examination.

In accordance with the Sub-Regulation 3 of Regulation 42 of Company Secretaries Regulations 1982, the council of the Institute of Company Secretaries of India (ICSI) shall have the power to decide the individual subject(s)/group(s) of the CS course examination from which a candidate shall be exempted on the basis of prescribed criteria.

Accordingly, there are two option for claiming exemption in any paper of CS Foundation, CS Executive (Inter) and CS Final (Professional) examinations. Either you had secured minimum of 60 per cent marks in that particular subject/s in earlier sessions of CS Exams or you have passed such examination of any university or such professional institutes/bodies in India or abroad, as may be recognised by the council of CS Institute from time to time.

The Council of the Institute of Company Secretaries of India (ICSI) vide announcement dated 17/11/2013 has modified the criteria for granting paper-wise exemptions to Company Secretaries (CS) students on the basis of their higher qualifications.

As a result of which, with effect from Sunday, 01 December 2013, CS students (Inter and Final) will get paper wise exemptions in the Executive Programme and Professional Programme Examinations if and only if they are either qualified Cost and Management Accountant (CMA) or Bachelor of Laws (LLB).

In other words, if you are qualified Cost Accountants and LLB then only you will get paper wise exemptions in CS Executive Programme and CS Professional Programme Examinations. Earlier to these revised guidelines all CS students having degree of Cost Accountant (CMA), MBA, MCOM, LLB, LLM, MA (CS) and Commerce Graduates were eligible for claiming paper wise exemption in CS examinations.

Note that prior to issue of revised guidelines of paper wise exemption, whatever exemption were already granted to students, will remain valid till validity of their registration or completion of the respective stage of examination, whichever is earlier. That means if you had already claimed exemption then your exemption shall remain valid and you are not required to claim it again till its validity.

Paper wise Exemption on the basis of Higher Qualifications

As per the present guidelines, students pursuing CS Course are eligible for ICSI paper-wise exemptions based on the following higher qualifications acquired by them:

- Passed LL.B. (with 50% or more marks in the aggregate)

- Passed the Final Course of The Institute of Cost Accountants of India [ICAI(Cost)]

Following guidelines would now be followed for claiming exemptions in respective papers of CS Executive Dec 2023 exams as well as CS Professional Programme Dec 2023 examinations:

A) The Bachelor of Laws (LLB):

Those students who are qualified LLB (Qualification Code-047) with securing minimum 50% marks in the aggregate shall be eligible for claiming paper-wise exemption in Paper 7-Industrial, Labour and General Laws (Paper Code – 327 of Module-2) of CS Executive Programme under New Syllabus (2017).

Remember the LLB Qualification Code-047 and Paper Code – 327 for claiming exemption. However, no paper-wise exemptions available for this qualification in any paper covered under Professional Programme Stage

LLB is a 3 Years Degree Course or 5 years integrated law course to be done from a recognized University / Institute either constituted under an Act of Parliament or approved by All India Council for Technical Education (AICTE)/ Association of Indian Universities (AIU).

Note that you are not eligible for claiming ICSI paper wise exemptions in CS Executive Exams even you are a qualified Chartered Accountant (CA) or having any other professional qualifications.

B) Cost and Management Accountant (CMA):

ICSI allows paper wise exemption in CS Executive and CS Professional exams for candidates who passed CMA Final examination of the Institute of Cost Accountant of India (ICAI). Remember the CMA Qualification Code-044 and respective subject or paper codes are as follows:

A – Exemption in CS Executive Programme:

Module-1:

Paper-2: Cost and Management Accounting (Paper Code-322)

Paper-4: Tax Laws and Practices (Paper Code- 324)

Module-2:

Paper-5: Company Accounts and Auditing Practices (Paper Code-325)

Students who have been granted exemption in Executive Programme Stage on the basis of having passed Final Course of The Institute of Cost Accountants of India (ICAI-Cost) are required to submit their request for exemptions afresh for papers covered under the Professional Programme Stage & the same are not granted automatically.

B – Exemption in CS Professional Programme:

Module-1:

Paper-1: Advanced Company Law and Practice (Paper Code-331)

Module-2:

Paper-5: Financial, Treasury and Forex Management (Paper Code-335)

Module-3:

Paper-7: Advanced Tax Laws and Practice (Paper Code-337)

Thus, the exemption under reciprocal arrangement with Institute of Cost Accountants of India (ICAI) will continue. Students need to upload scanned attested copies of mark sheets of all parts/semesters of LLB degree or scanned attested copies of final pass certificate of ICAI(cost).

Fee and Last Date for paper wise Exemption

Fee for paper wise exemption is ₹1000/- (per subject) and is to be paid through ‘Online Services’ using Credit Card/Debit cards /Net banking /Bank Challan.

Last date of applying for paper wise exemptions is 10th October 2023 for Dec 2023 session and 9th April 2024 for June 2024 session of CS Inter (Executive Programme) and CS Final (Professional Programme) Examination.

How to Claim Paper-wise Exemption in ICSI June 2023 Exams

Following steps/process to be followed for getting ICSI paper wise exemption in CS Inter/Final examinations to be held in June/December every year.

Step-1 (Login Account):

CS Institute has created a new portal named Student Member Application Software Hosting (SMASH) for online services for students and members. You may visit smash.icsi.in and create your account.

If, you have already created your account with SMASH then, please login to your ICSI account as shown below providing your user name and password along with verification code for security purpose.

Use your ICSI 17 digit registration number as username for login to ICSI Smash Portal. In case, you forgot your password, please click on Forgot Password. However, if you have not registered on CS Institute online portal then click here to register yourself or create your account on SMASH portal.

After successful Login, select Subject exemption from MODULE Tab menu and apply for exemption as shown in this screenshot.

MODULE → SUBJECT EXEMPTION → APPLY FOR QUALIFICATION BASED EXEMPTION REQUEST.

Step-2 (Fill up Form):

After applying for exemption on qualification basis, you will be required to fill up request form by the following last dates to become eligible for such exemptions in the respective examination sessions:

- 10th October to become eligible for exemption in December Session of Examinations (e.g. by 10th October, 2023 for eligibility in December, 2023 Session; and

- 9th April to become eligible for the exemption in June Session of Examinations (e.g. by 9th April, 2024 for eligibility in June, 2024 Session.

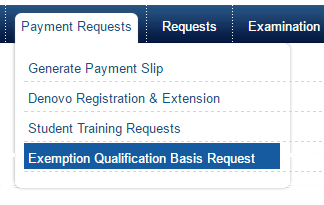

Go to Payment Request drop down option tab menu and click on Exemption Qualification Basis Request.

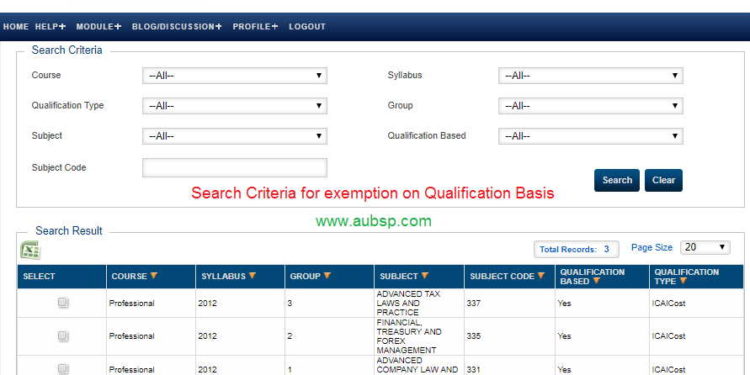

Now, fill up the required information for claiming your paper wise exemptions for respective examinations. You have to search criteria e.g. Course, Syllabus, Qualification Type, Group, Subject, Qualification base and Subject code for claiming your exemption.

Thereafter, you will see the list of subjects on search result for which paper wise exemption is available. Now, select the particular subject and apply for exemption for the same as shown in this screenshot below.

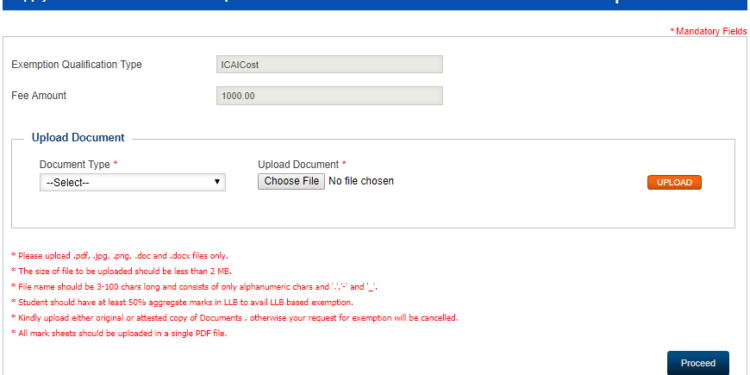

Step-3 (Upload Supporting Documents):

Upload the Supporting Document(s) viz. scanned attested copies of mark sheets of all parts/semesters of LLB degree or scanned attested copies of final pass certificate of ICAI (Cost), as the case may be. Please note the following important information while uploading your supporting documents for claiming exemption in CS foundation/executive/professional programme course.

- Please upload .pdf, .jpg, .png, .doc and .docx files only.

- The size of file to be uploaded should be less than 2 MB.

- File name should be 3-100 chars long and consists of only alphanumeric chars and ‘.’,’-‘ and ‘_’.

- Student should have at least 50% aggregate marks in LLB to avail LLB based exemption.

- Kindly upload either original or attested copy of Documents , otherwise your request for exemption will be cancelled.

- All mark sheets should be uploaded in a single PDF file.

Step-4 (Submit Request):

After selecting the mode of payment (Credit/Debit Card/ Net Banking/ Challan), click on Submit Request. You will see a new window showing your request ID and Transaction ID.

The Request ID and Transaction ID shall automatically be generated for control purpose and before actual payment transaction starts. Please note this for all future communication. That means it does not confirm that payment has been received by CS Institute.

Step-5 (Make Payment):

Finally, click on the button Proceed For Payment and make the payment by using your Master or Maestro Debit/ Credit Card. If you have internet banking facility, then you may create Virtual Card for making payment of fee to ICSI.

In case you shall pay the requisite fee online, please check from the payment status from your bank/ account statement immediately. You may get a print out of the acknowledgement from the ICSI portal after one working day.

Contact for Help:

No exemption shall be given on the basis of any other higher education. For more help and for exemption related queries, please send your mail at mail id: exemption@icsi.edu. The last date of applying for exemption is 9th April for June Session of examinations and 10th October for December session of examinations.

Last date for submission of request for cancellation of Exemption

Since the grant / cancellation of exemption(s) have a bearing on the computation of examination results, the students are strictly advised to follow the guidelines in letter and spirit to avoid complications at the time of appearing in the examinations and/or declaration of results.

- ICSI Dec 2023: For the students who have enrolled for Dec, 2023 session and the requests should be submitted at exemption@icsi.edu as per the schedule given below:

- CS Executive Programme Examination: 10th October, 2023.

- CS Professional programme Examination: 10th October, 2023.

- ICSI June 2024 Exams: For the students who have enrolled for June, 2024 session and the requests should be submitted at exemption@icsi.edu as per the schedule given below:

- CS Executive Programme Examination: 9th April, 2024.

- CS Professional programme Examination: 9th April, 2024.

Paper-wise exemption in any paper(s) of the examination, once sought by the candidate and granted by the Institute remains valid and is printed in his/her Admit Card (Roll No.) and taken on record for computation of his/her results unless it is cancelled by the student by submitting a formal request to the Institute. Note that exemption once cancelled on student’s request shall not be revived subsequently under any circumstances.

Therefore, candidates desirous of cancelling the ICSI paper-wise exemption granted to them are advised to send a formal request at E-Mail id exemption@icsi.eduSuch requests for cancellation should be sent latest by 10th October, 2023.